FXSMS Market Insights Blog

The FXSMS Blog delivers clear, data-driven insights on forex, gold, and crypto markets. Our analysis focuses on market trends, risk management, and algorithm-based trading strategies—designed to help traders make smarter, more disciplined decisions without hype or emotion.

The 5-Minute RSI Reversal Strategy (A Simple, Realistic Breakdown)

The RSI is one of the most misunderstood indicators in trading. Many traders treat it like a buy-and-sell button — and that’s exactly why they lose money. In this guide, we’ll break down a simple 5-minute RSI reversal strategy that focuses on structure, patience, and...

The Hidden Danger of High Leverage — Why It Destroys Traders

High leverage looks like a shortcut to big profits. In reality, it’s usually a shortcut to blowing accounts. Leverage doesn’t just increase your upside — it amplifies every mistake, every emotional decision, and every normal market wiggle into a potentially fatal hit....

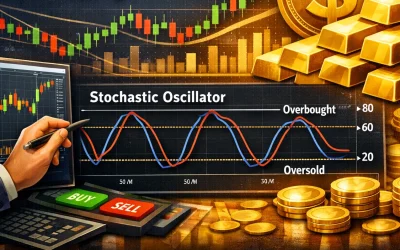

Stochastic Oscillator: How to Use It for Gold Scalping (XAU/USD)

Stochastic Oscillator: How to Use It for Gold Scalping (XAU/USD) If you scalp gold (XAU/USD), you already know one thing: price can move fast, reverse sharply, and fake you out right when you think you’re right. The Stochastic Oscillator is a simple momentum tool that...

The 1% Rule: Why It Saves Traders From Blowing Accounts

In the world of trading, whether in forex or gold, managing your risk is paramount. One of the most effective strategies to safeguard your trading account is the 1% Rule. This simple yet powerful guideline helps traders maintain discipline and avoid catastrophic...

Why Most Traders Lose (And It’s Not the Strategy)

Why Most Traders Lose (And It’s Not the Strategy) Ask ten traders why most people lose money in the markets, and you’ll usually hear the same answer: bad strategies. But the truth is far less comforting — and far more important. Most traders don’t fail because their...

What Is Slippage and How to Avoid It

Slippage is a common term in the world of forex and gold trading that every trader should understand. It refers to the difference between the expected price of a trade and the actual price at which the trade is executed. In this article, we will explore what slippage...

Understanding NFP: Why It Causes Massive Volatility

The Non-Farm Payroll (NFP) report is one of the most significant economic indicators for traders in the forex and gold markets. Understanding how NFP affects market volatility can help you make informed trading decisions. In this article, we will explore what NFP is,...

Why Backtest Results Often Don’t Match Live Results

As a trader, you may have experienced the frustration of seeing your backtest results shine, only to find that live trading yields disappointing outcomes. Understanding the reasons behind this discrepancy is crucial for your trading success. In this article, we will...

Why Crypto Crashed Over the Weekend (And What Traders Should Do Next)

Crypto markets can move fast — but weekend moves often feel even more extreme. If you saw prices drop sharply over the weekend, you’re not alone. The important thing is understanding why these weekend “crashes” happen, what’s actually driving them, and what a smart...

Why Gold Often Reverses at Round Numbers

Gold trading can be both exciting and challenging, especially for those new to the market. One fascinating phenomenon you may notice is how gold prices often reverse at round numbers. Understanding this behavior can enhance your trading strategy and improve your...

Mastering FOMO: How to Avoid Chasing Losing Trades

Fear of missing out (FOMO) is a common psychological hurdle for traders, particularly in the fast-paced world of forex and gold trading. This article will guide you through understanding FOMO, its impact on trading decisions, and practical strategies to avoid chasing...

OANDA Guide for Beginners: How to Place Your First Trade

Welcome to your comprehensive guide on placing your first trade using OANDA, a leading trading platform for forex and gold. Whether youre just starting or looking to refine your skills, this guide will walk you through the essential steps to make your first trade with...

RSI Explained: The Best Settings for Gold Scalping

Understanding the Relative Strength Index (RSI) can significantly enhance your trading strategy, especially in the volatile world of gold scalping. This article will break down the RSI, explain its importance, and provide practical guidance on the best settings to use...

Stop-Loss Placement: Common Mistakes and How to Fix Them

Effective stop-loss placement is a crucial aspect of risk management in trading. For both beginner and intermediate forex and gold traders, understanding how to set stop-loss orders correctly can mean the difference between a successful trade and a costly mistake. In...

What Is a Pip? The Complete Beginner’s Guide

Understanding the concept of a pip is essential for anyone looking to navigate the world of forex and gold trading. This guide will break down what a pip is, why it matters, and how you can use this knowledge to make informed trading decisions. Whether youre just...

Rate Decisions Explained: How Central Banks Move Markets

Understanding how central banks influence the financial markets is crucial for any trader. Rate decisions made by these institutions can create significant price movements in currencies and commodities like gold. This article will break down the mechanics of rate...

What Is Backtesting? A Beginner’s Guide

Backtesting is a critical component of successful trading strategies, especially for forex and gold traders. It allows you to evaluate the viability of a trading strategy by applying it to historical market data. In this guide, we will break down what backtesting is,...

Why Is Gold So Volatile? 5 Drivers Behind XAU/USD Price Swings

Gold prices can move $50 or more in a single trading session, creating both tremendous opportunity and significant risk for traders. If you've ever watched XAU/USD spike 2% within minutes or collapse during what seemed like calm market conditions, you've witnessed...

How to Stop Overtrading: 7 Rules Every Trader Needs

Overtrading is a common pitfall for many traders, especially those who are just starting in the forex and gold markets. It can lead to significant losses and emotional stress. Understanding how to manage your trading habits is crucial for long-term success. This...

MT4 vs MT5: What’s Better for Gold Trading?

As a trader, choosing the right platform is crucial for your success, especially when trading valuable assets like gold. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are two of the most popular trading platforms available today. In this article, we will explore the...

Moving Averages: Which Periods Work Best on Gold?

Understanding moving averages is essential for any trader looking to navigate the gold market effectively. These indicators can help identify trends, determine entry and exit points, and manage risk. In this article, we will explore which moving average periods work...

Risk-to-Reward Ratio: What Actually Works in Real Markets

Understanding the risk-to-reward ratio is crucial for any trader looking to succeed in the forex and gold markets. This concept not only helps you make informed trading decisions but also plays a significant role in effective risk management. In this article, we will...

Understanding Lot Sizes: Micro, Mini, and Standard Explained

When diving into the world of forex trading, one of the most critical concepts to grasp is the idea of lot sizes. Understanding micro, mini, and standard lots can significantly impact your trading strategy, risk management, and overall success. This article will break...

How to Trade Gold Safely During NFP

Trading gold during the Non-Farm Payroll (NFP) report can be a lucrative opportunity for forex and gold traders. However, the volatility surrounding this key economic event can also pose significant risks. In this article, we will explore how to navigate these...