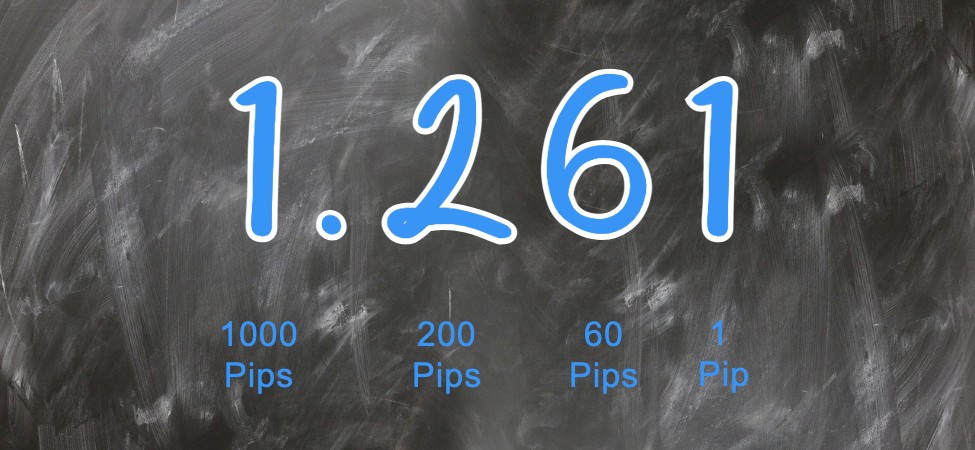

Forex trading can be a lucrative way to make money, but it is important to understand the ins and outs of the market. One of the most important concepts to understand is a PIP, which stands for Percentage in Point. A PIP is a unit of measurement used in Forex trading to define the smallest change in the exchange rate between two currencies.

It is equivalent to the smallest price change a currency pair can make, usually 0.0001. Knowing how to use a PIP to your advantage is essential to successful Forex trading. By understanding the concept of a PIP, you can effectively use it to your advantage to maximize your profits and minimize your losses.

Definition of a PIP

A PIP is a unit of measurement used in Forex trading to define the smallest change in the exchange rate between two currencies. It is equivalent to the smallest price change a currency pair can make, usually 0.0001. A PIP is calculated as follows: The first number is the amount of pips you will make if the exchange rate goes up.

The second number is the amount of pips you will lose if the exchange rate goes down. For example, when buying one British Pound (GBP) with two U.S. Dollars (USD), the exchange rate will always be 1.4000. This means that for every 1 GBP you buy, 2 USD will be taken from you. If you buy GBP/USD at 1.4000 and then the GBP/USD rate went to 1.4005, you would have made 5 pips because For every 1 GBP you bought, you now have 1.4005 GBP. You would have gained 5 pips from this exchange rate change.

How to calculate a PIP

To calculate a PIP, you start with the exchange rate of the currency pair and then add or subtract 0.0001 to find the PIP. For example, let’s say you are trading the USD/CAD currency pair and the current rate is 1.31. You would add 0.0001 to get a PIP of 0.000131. Next, you would multiply the base exchange rate by the PIP. In this case, the exchange rate would be 1.3131. Finally, you would subtract the PIP from the exchange rate. In this case, the new exchange rate is 1.3131 – 0.000131 equal to 1.3099.

Examples of a PIP

For example, when buying one British Pound (GBP) with two U.S. Dollars (USD), the exchange rate will always be 1.4000. This means that for every 1 GBP you buy, 2 USD will be taken from you. If you buy GBP/USD at 1.4000 and then the GBP/USD rate went to 1.4005, you would have made 5 pips because For every 1 GBP you bought, you now have 1.4005 GBP. You would have gained 5 pips from this exchange rate change. Another example is when you buy one Canadian Dollar (CAD) for 1.2265 US dollars. If the exchange rate then changes to 1.2268, you have lost one pip.

How to use a PIP to your advantage

When trading foreign exchange, it is important to keep in mind that each currency pair has a specific rate of change. This means that if you buy a currency pair, you are making a prediction as to which rate will be higher when the trade ends. The key to successful Forex trading is to make sure that you are making more pips (smallest price changes) than you are losing pips. Using a PIP to your advantage can help you do this because it allows you to keep track of the profits and losses with a greater degree of precision.

You can use a PIP to see the exact amount you have gained or lost from a trade. It takes the guesswork out of the equation and gives you a better idea of the amount you can expect to keep at the end of the trade. Additionally, when you buy a currency pair, you are also buying the PIP. This gives you an added layer of protection from losing money from a change in the exchange rate.

Benefits of using a PIP

Help you see profit or loss in finer detail. The smallest change in the exchange rate is a PIP, which is roughly equivalent to 0.0001. This means that the difference of one pip between two exchange rates is around $10.

Offer better protection against significant changes in the exchange rate. The PIP buys you a certain degree of protection against large changes in the exchange rate. If you have bought a currency pair and the PIP, then a change in the exchange rate that is less than the PIP will not affect you.

Allow you to buy more currency pairs and extend your trading strategy. Trading with a PIP allows you to buy more currency pairs, which allows you to extend your trading strategy. This is because you are able to take into account even the smallest change in the exchange rate.

Strategies to use when trading with a PIP

When the exchange rate is in your favor, buy a PIP. If the exchange rate is in your favor, you should buy a PIP. This means that you are setting a cap on the maximum amount of profit you can make from the trade.

When the exchange rate is against you, don’t buy a PIP. If the exchange rate is against you, you should not buy a PIP. This means that you are setting a cap on the maximum amount of loss you can make from the trade.

Risks associated with trading with a PIP

Over time, the exchange rate will fluctuate, and this may cause you to lose pips. You may be more aware of the losses you are making, but you might not realize that you are losing more money due to the exchange rate. This is when the PIP can be dangerous. If the exchange rate continues to move against you, it could lead to larger losses than you had anticipated. Another risk associated with using a PIP is that you may have set a cap on how much you can gain from trade.

You may have a cap on the amount of money you can make when the exchange rate is in your favor and another cap on the amount you can lose when the exchange rate is against you. If the exchange rate moves in your favor, but not enough to gain the maximum amount of profit allowed by the PIP, you will not make any extra money.

Tips for successful Forex trading with a PIP

Understand the risk of using a PIP. The PIP is a valuable way to keep track of profits and losses in your trading. However, it is important to remember that it is a cap on potential profit. This means that you may be more aware of the losses you are making, but the cap on profit may prevent you from making a significant amount of money.

Know when to buy and sell a PIP. Before you start trading with a PIP, make sure you understand when to buy and sell a PIP. You should sell a PIP when the cap on loss is reached, and you should buy a PIP when the cap on profit is reached.

Keep track of the exchange rate. Keep track of the exchange rate when trading with a PIP. This will help you better understand when you should sell and buy the PIP.